Financial technology, or fintech, has emerged as a transformative force reshaping the traditional landscape of financial services. In this comprehensive article, we will explore the essence of fintech, evaluate its impact, and delve into the current situation of this dynamic industry. From the evolution of fintech to its key players and the challenges it faces, we aim to provide a comprehensive guide to the fintech revolution.

Defining Fintech: A Fusion of Finance and Technology Unraveling the Fintech Concept

Fintech, a portmanteau of "financial technology," refers to the innovative use of technology to deliver financial services more efficiently and effectively. It encompasses a broad spectrum of applications, ranging from mobile payment solutions and digital banking to blockchain-powered cryptocurrencies and robo-advisors. Fintech is not merely a technological upgrade but a fundamental shift in how financial services are conceptualized, delivered, and consumed.

Key Elements of Fintech

1. Mobile Payments and Digital Wallets: Fintech has revolutionized the way we make transactions. Mobile payment solutions and digital wallets, such as Apple Pay, Google Pay, and PayPal, allow users to make seamless and secure transactions using their smartphones.

2. Online Banking and Neobanks: The rise of online banking and neo banks has challenged traditional banking models. Digital-only banks, like Chime and Revolut, leverage technology to offer innovative, user-friendly, and often fee-free banking experiences.

3. Cryptocurrencies and Blockchain: Blockchain technology, the backbone of cryptocurrencies like Bitcoin and Ethereum, has disrupted the traditional financial ecosystem. Decentralized and secure, blockchain provides transparent and tamper-resistant transactions, reducing the need for intermediaries.

4. Robo-Advisors: Fintech has democratized investment with robo-advisors. These automated platforms use algorithms to provide investment advice and manage portfolios, making wealth management more accessible to a broader audience.

5. Insurtech: Insurance technology, or insurtech, utilizes technology to streamline and enhance the insurance process. From digital claims processing to personalized insurance solutions, insurtech is reshaping the insurance landscape.

Evaluating the Impact of Fintech

Advantages of Fintech

1. Enhanced Accessibility: Fintech has democratized financial services, making them accessible to individuals and businesses worldwide. Online banking, digital payments, and robo-advisors break down geographical barriers, providing financial tools to the unbanked and underbanked populations.

2. Cost Efficiency: Fintech solutions often operate with lower overhead costs compared to traditional financial institutions. This cost efficiency translates into reduced fees for consumers, making financial services more affordable.

3. Innovation and Customization: Fintech thrives on innovation, constantly introducing new ways to manage finances. From personalized investment strategies to tailored insurance plans, fintech allows users to customize their financial experience based on individual needs and preferences.

4. Speed and Efficiency: Traditional financial processes can be time-consuming and bureaucratic. Fintech leverages technology to streamline operations, reducing processing times for transactions, loan approvals, and other financial services.

Challenges and Concerns

1. Security and Privacy: The digitization of financial services raises concerns about the security and privacy of sensitive information. Fintech companies must implement robust cybersecurity measures to safeguard against data breaches and unauthorized access.

2. Regulatory Compliance: Fintech operates in a complex regulatory environment, with varying rules and standards across jurisdictions. Achieving and maintaining regulatory compliance poses a significant challenge for fintech firms, requiring continuous adaptation to evolving legal frameworks.

3. Market Saturation: The rapid proliferation of fintech startups has led to market saturation in certain segments. Fierce competition may hinder the growth and sustainability of individual players, necessitating unique value propositions to stand out in the crowded fintech landscape.

4. Technological Risks: Dependence on technology exposes fintech companies to technological risks, including system failures, cyberattacks, and disruptions. Continual investments in technology infrastructure and risk management are essential to mitigate these potential challenges.

The Current State of Fintech: Key Trends and Developments

Key Players in Fintech

1. Square: Known for its point-of-sale systems, Square has expanded its offerings to include small business loans, payment processing, and the popular Cash App, enabling peer-to-peer payments.

2. Revolut: As a neobank, Revolut offers a range of financial services, including currency exchange, cryptocurrency trading, and global spending with no hidden fees. Its user-friendly app has gained popularity for its simplicity and versatility.

3. Adyen: Adyen is a global payment company providing end-to-end payment solutions. Its platform enables businesses to accept payments in multiple currencies through various channels, offering flexibility and ease of use.

4. Coinbase: A prominent player in the cryptocurrency space, Coinbase provides a user-friendly platform for buying, selling, and managing various cryptocurrencies. Its influence extends beyond individual users to institutional investors and businesses.

5. Ant Group: As an affiliate of Alibaba Group, Ant Group is a financial technology powerhouse in China. Its mobile payment platform, Alipay, and wealth management services have positioned it as a major player in the global fintech scene.

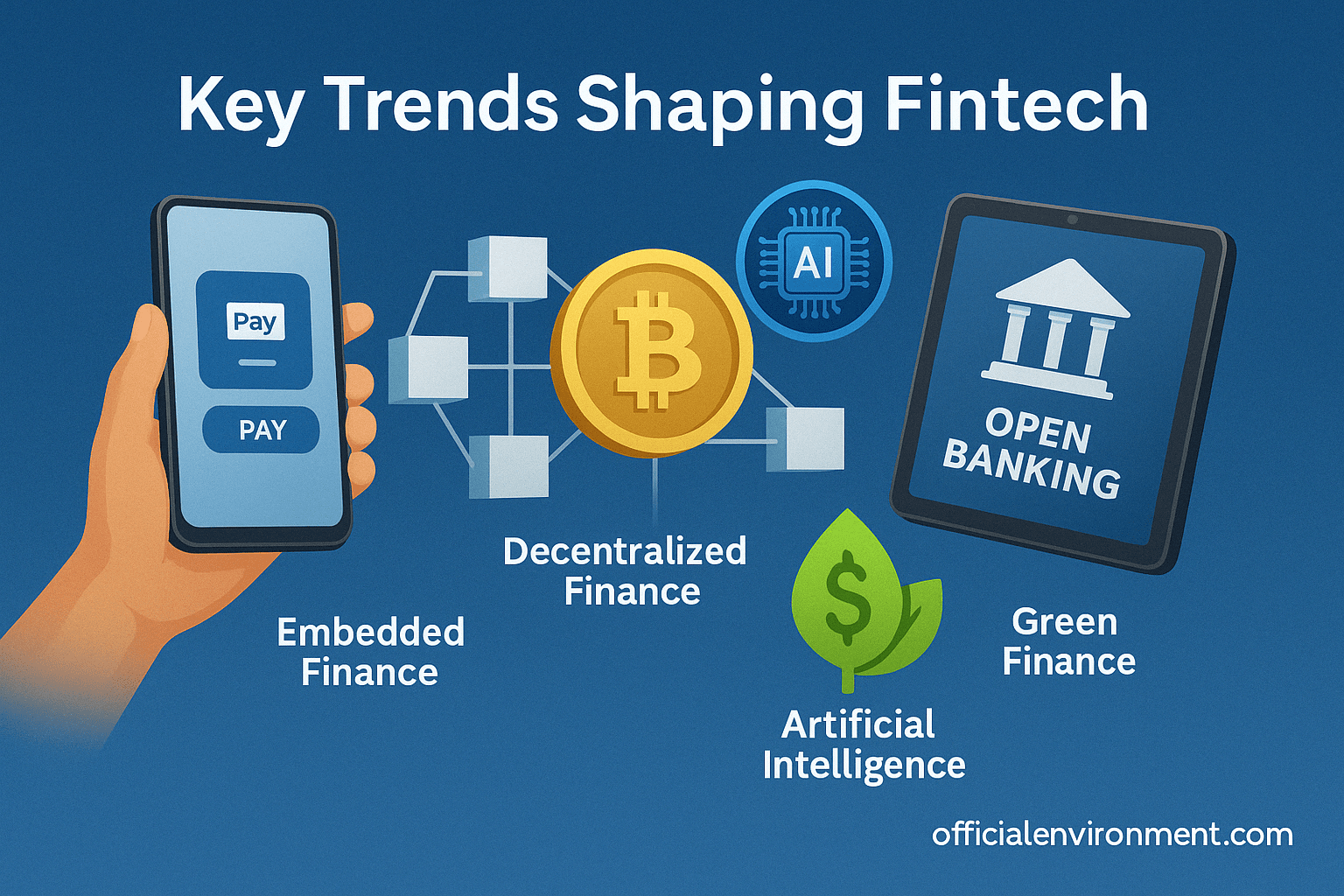

Key Trends Shaping Fintech

1. Embedded Finance: Fintech is increasingly integrated into non-financial products and services, a concept known as embedded finance. From embedded payment options in e-commerce platforms to financial tools integrated into software applications, this trend blurs the lines between finance and other industries.

2. Decentralized Finance (DeFi): DeFi leverages blockchain technology to recreate traditional financial services, such as lending and borrowing, without traditional intermediaries. Smart contracts on blockchain enable transparent and automated financial transactions.

3. Open Banking: Open banking initiatives promote the sharing of financial data between banks and third-party fintech providers. This collaborative approach enhances competition, fosters innovation, and allows consumers to access a broader range of financial services.

4. Artificial Intelligence (AI) and Machine Learning: Fintech firms are increasingly leveraging AI and machine learning for data analysis, risk assessment, fraud detection, and customer personalization. These technologies enhance decision-making processes and improve the overall efficiency of financial services.

5. Green Finance: With a growing focus on sustainability, fintech is playing a role in promoting green finance. Fintech solutions are being developed to support environmentally friendly investments, track carbon footprints, and provide sustainable financial products.

Future Prospects

Emerging Opportunities in Fintech

1. Digital Identity Solutions: Fintech is poised to address challenges related to digital identity verification. Innovations in biometrics, blockchain, and secure document verification are paving the way for more reliable and convenient digital identity solutions.

2. Cross-Border Payments: Fintech is streamlining cross-border payments by offering faster, more cost-effective alternatives to traditional remittance services. Blockchain and digital wallets play a crucial role in facilitating seamless and instant international transactions.

3. Financial Inclusion: Fintech has the potential to bridge the gap in financial inclusion by providing affordable and accessible services to underserved populations. Mobile banking, microfinance through fintech platforms, and innovative credit scoring methods contribute to this inclusive vision.

4. RegTech: Regulatory technology, or RegTech, is emerging as a specialized branch of fintech. RegTech solutions leverage technology to help financial institutions comply with regulatory requirements efficiently, reducing compliance costs and enhancing transparency.

In Conclusion

The fintech revolution is reshaping the financial services landscape, ushering in an era of accessibility, innovation, and efficiency. As key players continue to push boundaries and new trends emerge, the future of fintech holds immense promise. While challenges such as security, regulatory compliance, and market saturation persist, the industry's adaptability and commitment to addressing these issues bode well for sustained growth.

For consumers, fintech translates into a more personalized, convenient, and inclusive financial experience. For businesses, it presents opportunities for efficiency gains, enhanced customer engagement, and the exploration of novel revenue streams. As fintech continues to evolve, stakeholders across the financial ecosystem must stay abreast of developments, fostering a collaborative environment that balances innovation with responsible practices. The journey of fintech is far from over, and the road ahead promises further transformation and advancement in the realm of finance and technology.